Lifestyle

PRESTIGIOUS REAL ESTATE - PERCEPTION AND PRICES OF THE FRENCH MARKET

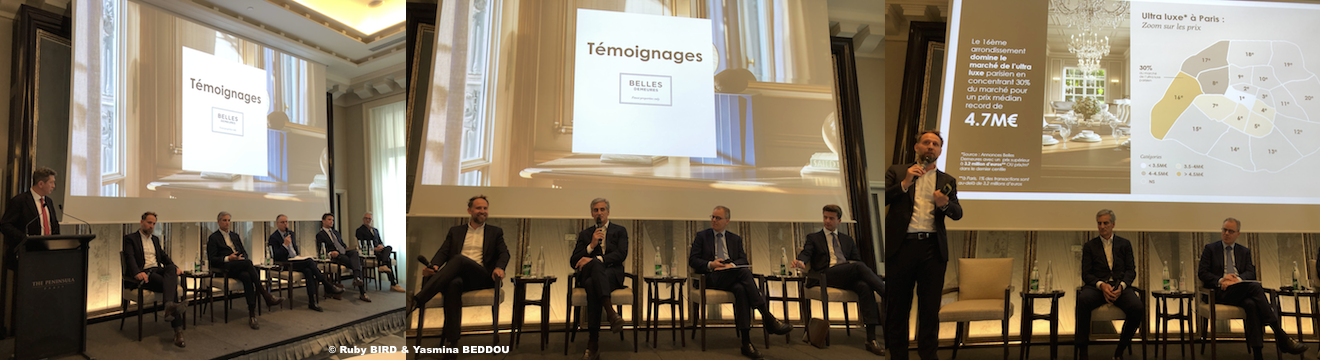

EXCLUSIVE STUDY "BELLES DEMEURES"

(Source: © Ruby BIRD & Yasmina BEDDOU)

Real estate : The Decline in Prices observed in the old Properties did not occur for Exceptional Goods.

Exclusive Study "Prestigious real estate Perception and Prices of the French Market" by Belles Demeures...

Exclusive Study "Prestigious real estate Perception and Prices of the French Market" by Belles Demeures...

While Old Real Estate has suffered from the Tightening of Credit Conditions over the Last Two Years, Luxury Real Estate has not shown the Same Results. On the Contrary, Prices in the Luxury Market are up +1.7% in France over One Year, compared to -2.5% for the Traditional Market... This Rise in Prices for these Exceptional Goods is observed throughout the Territory? Are the most Luxurious Seaside Resorts still as Attractive? The Prestigious Real Estate Site Belles Demeures takes stock of this Vibrant Market and reveals the Prospects of Future Buyers and Sellers of these Exceptional Properties.

- In France, Luxury and Ultra-Luxury Real Estate still attract

Luxury resists in a Complex Economic and Banking Context With fewer than 9,000 Transactions over 1.2 million Euros and some 870 Exceptional Sales over 3.2 million Euros in France Last Year, The French Luxury Real Estate Market is experiencing Solid Growth of +2.3% for Houses and +1.1% for Apartments on average over One Year.

Luxury resists in a Complex Economic and Banking Context With fewer than 9,000 Transactions over 1.2 million Euros and some 870 Exceptional Sales over 3.2 million Euros in France Last Year, The French Luxury Real Estate Market is experiencing Solid Growth of +2.3% for Houses and +1.1% for Apartments on average over One Year.

Performances that run counter to those observed on the Traditional Market with -2.1% for Houses and -3% for Apartments over the Same Period. Among the First Explanations: the Very Low Impact of the Increase in Interest Rates for this Premium Clientele. In fact, more than half (54%) of Future Buyers surveyed by Belles Demeures say that this increase in Interest Rates does not affect their Plans.

- Exceptional Real Estate: Paris and the Coastal Regions are Popular

In Paris, a Great Performance for Exceptional Properties. The French Capital is the Very Example of this Dissonance between the Traditional Market and the Luxury Market. In the Space of Two Years, So-Called Classic Properties have seen their Prices drop by 12%, falling below the Symbolic Bar of €10,000/m² last September, while over the Same Period, Luxury Apartments are resisting and displaying Growth of +2.2%. The Median Price of an Exceptional Apartment in Paris thus Amounts to 1.7 million Euros (€17,441/m²) as of June 1, 2024. With even more Exceptional Services, the Median Amount can even reach 4 .2 million Euros for Ultra-Luxury.

In Paris, a Great Performance for Exceptional Properties. The French Capital is the Very Example of this Dissonance between the Traditional Market and the Luxury Market. In the Space of Two Years, So-Called Classic Properties have seen their Prices drop by 12%, falling below the Symbolic Bar of €10,000/m² last September, while over the Same Period, Luxury Apartments are resisting and displaying Growth of +2.2%. The Median Price of an Exceptional Apartment in Paris thus Amounts to 1.7 million Euros (€17,441/m²) as of June 1, 2024. With even more Exceptional Services, the Median Amount can even reach 4 .2 million Euros for Ultra-Luxury.

On the Left Bank of the Seine, Certain Districts continue to rub Shoulders with the Peaks. Properties in the 7th Arrondissement, with a Median Price of 3.9 million Euros as of June 1, 2024, have recorded Growth of +5% over the Last Two Years. Luxury Real Estate is performing well in the 6th Arrondissement with +2.1% over Two Years. Regarding the 16th Arrondissement, the Price of Exceptional Properties also increased by +1.9%. This District dominates the Parisian Ultra-Luxury Market by concentrating 30% of the Offer for a Record Median Price of 4.7 million Euros.

- An Observation confirmed by Prestige Market Experts by adding:

"The Parisian Market is experiencing confirmed Dynamics for the High-End Real Estate Market. In this First Half, Emile Garcin Properties recorded Several Sales of Apartments between 4 million and 12 million Euros to Personalities, mainly Foreigners Americans and Businessmen. The Parisian Market also reports a Slowdown in the Number of Transactions, a Loss of Prices for Certain Sellers disappointed at not having benefited from the Euphoria of a Bygone Market. Sales Time is lengthening, however, we have noted in Recent Weeks that the Market is unlocking as soon as the Price is justified" comments Nathalie Garcin, Co-President of Emile Garcin Properties.

"The Parisian Market is experiencing confirmed Dynamics for the High-End Real Estate Market. In this First Half, Emile Garcin Properties recorded Several Sales of Apartments between 4 million and 12 million Euros to Personalities, mainly Foreigners Americans and Businessmen. The Parisian Market also reports a Slowdown in the Number of Transactions, a Loss of Prices for Certain Sellers disappointed at not having benefited from the Euphoria of a Bygone Market. Sales Time is lengthening, however, we have noted in Recent Weeks that the Market is unlocking as soon as the Price is justified" comments Nathalie Garcin, Co-President of Emile Garcin Properties.

“All of the Transactions carried out in the First Half of 2024 by the Parisian Agencies of the Daniel Féau Group demonstrate that the Parisian Residential Real Estate Market is Extremely Resilient with Prices now Almost Stable. The Year 2023 as well as the First Quarter of 2024 allowed the Market to return to Near-Normal Fluidity. This is particularly notable for Real Estate with a Unit Value greater than three million Euros, a Segment in which Daniel Féau remains the Leader in Market Share" expresses Eric Donnet, Managing Director of the Daniel Féau Group.

"Last Year was Very Positive for the Ultra-Luxury Market and for Junot Fine Properties - Knight Frank, which achieved Record Transactions in Paris between €50M and €80M, and with an Average Price per m² of €30,400. The Ultra-Luxury Market is driven by Private Hotels (42% of sales), Properties with Outdoor Spaces (75% of Sales) and "Turnkey Properties" (56% of Sales). On the Buyer Side, Foreigners are in the Majority (75%), mainly from the United States and Asia" says Sébastien Kuperfis, President of Junot Fine Properties - Knight Frank.

"Since the Beginning of the Year, the High-End Real Estate market in Paris has maintained Relative Stability despite Persistent Economic Challenges. Although Prices recorded a Slight Decline on Average compared to the Previous Year, this one is significantly Less Important than what was feared." Richard Tzipine, Managing Director of Barnes.

This Interest in Exceptional Parisian Properties seems to be Lasting and not Very Sensitive to Ephemeral Events, even Prestigious Ones. If it is True that Paris will become the Capital of the World this Summer, only One in Five Project Leaders predict that the City's Strong Exposure in the Media and on Social Networks during the 2024 Olympic Games will have a Significant Influence important to the Market.

- The only Downside: the Luxurious Houses of Île-de-France.

After having long benefited from Remarkable Dynamism, sometimes greater than that of the Capital, Exceptional Real Estate in Île-de- France is struggling . Thus, Luxurious Houses located in Yvelines and Hauts-de-Seine, with Median Prices of 1.3 million and 1.4 million Euros, recorded a Price drop of -5.1% and -3 .2% over One Year. The Town of Neuilly-sur-Seine stands out by concentrating 40% of the Offer of Private Hotels in the West of Paris offered at a Median Price of 5.7 million Euros.

After having long benefited from Remarkable Dynamism, sometimes greater than that of the Capital, Exceptional Real Estate in Île-de- France is struggling . Thus, Luxurious Houses located in Yvelines and Hauts-de-Seine, with Median Prices of 1.3 million and 1.4 million Euros, recorded a Price drop of -5.1% and -3 .2% over One Year. The Town of Neuilly-sur-Seine stands out by concentrating 40% of the Offer of Private Hotels in the West of Paris offered at a Median Price of 5.7 million Euros.

"Unlike Paris, which can count on an International Clientele that is Very Little Dependent on Credit, Buyers who wish to become Owners of a Luxury House in Île-de-France are often Households from the Ile-de-France Region who, although Well-Off, still need to use Credit to buy their Family Property. The Price Dynamics observed for this Type of Property in Île-de-France are the Direct Consequence of the Doubling of Interest Rates in Two Years." analyzes Thomas Lefebvre, Vice-President Data at Belles Demeures (SeLoger Group).

“In Western Paris, we observe, thanks to our Locations in Neuilly, Boulogne, Saint-Cloud, Versailles and Saint-Germain-en-Laye, a Less Dynamic Market for Family Properties when Bank Financing is provided. These Markets nevertheless remain Fluid for Real Estate without any Defects." according to Eric Donnet, Managing Director of the Daniel Féau Group.

- Prestigious Real Estate: which are the most Dynamic Territories?

After Île-de-France, the Côte d'Azur is the Territory where we find the most Expensive Luxury Houses in France with a Median Price of 2.2 million euros (9,510€/m²) for a Property a Few Steps from the Water. In Saint- Tropez, the Median Price of Exceptional Properties in the City even peaks at 6.7 million euros. This Coastline of the Mediterranean Sea concentrates 14% of Luxury Real Estate Projects according to Future Buyers surveyed by Belles Demeures (compared to 14% in île-de-Fance).

After Île-de-France, the Côte d'Azur is the Territory where we find the most Expensive Luxury Houses in France with a Median Price of 2.2 million euros (9,510€/m²) for a Property a Few Steps from the Water. In Saint- Tropez, the Median Price of Exceptional Properties in the City even peaks at 6.7 million euros. This Coastline of the Mediterranean Sea concentrates 14% of Luxury Real Estate Projects according to Future Buyers surveyed by Belles Demeures (compared to 14% in île-de-Fance).

On the West Coast of the Country, Luxury Homes located on the Atlantic side and in Normandy continue to attract with Respective Price increases of +2.3% and +3.2% over one year: count 2.2 million Euros for an Exceptional House in Cap Ferret and 1.5 million in Deauville.

For Provence, a Region which also concentrates 14% of the Exceptional Real Estate Projects of those surveyed, Real Estate Prices increased by +7.2% in One Year with a Median Price of 1.75 million Euros ( 7,260€/m²) for a House on June 1, 2024. In the Commune of Saint-Rémy-de-Provence, the Median Price for a Luxury House even reaches 2 million Euros.

With a Price Increase of +8.1% over One Year in the Alps, Prices for Chalets are reaching New Heights, particularly those located in Courchevel which amount to 7.2 million Euros (Median Price).

"For the South of France and since the Beginning of 2024, the Character Real Estate Market remains very strong. Our Activity is driven by many Buyers and still a Lack of Quality Properties. The Buyers are of all European Nationalities as well that an American Clientele which has been present since the end of March. They are looking for a Change of Life in the South where the Quality of the Environment attracts them." explains Nathalie Garcin, Co-President of Emile Garcin Properties

"On the Atlantic Coast, it is the Arcachon Basin which is doing well. Projects have certainly been slowed down for a Year and a Half by the Rise in Rates, particularly in the 2 to 4 million Euros Market Segment, but we feel a Gradual Improvement since the Start of the Year." comments Richard Tzipine, Managing Director of Barnes.

Turnkey, a Criterion not to be neglected Beyond Geographical Characteristics, the Absence of Work also represents an Additional Criterion of Choice for Buyers since 60% are looking for a Turnkey Property without any Work and 60% would be even willing to pay more for such a Good.

“In 2024, we are seeing Strong Demand, particularly from Buyers from the Middle East and Asia, who are ready to spend more than €100 million on Properties that are both Historic and Turnkey,” says Sébastien Kuperfis, President. by Junot Fine Properties - Knight Frank.

Source: Presentation Study by Belles Demeures "Prestigious Real Estate - Perception And Prices Of The French Market"

With the Presence of:

* Richard Tzipine, Managing Director of Barnes.

* Eric Donnet, Managing Director of the Daniel Féau Group.

* Sébastien Kuperfis, President of Junot Fine Properties - Knight Frank.

* Martial Michaux, Commercial Director at Emile Garcin

* Thomas Lefebvre, Vice-President Data at Belles Demeures (SeLoger - Meilleurs Agents - Aviv Group)

* Caroline Evans De Gantès, General Manager Belles Demeures (SeLoger - Meilleurs Agents - Aviv Group)

Ruby BIRD

http://www.portfolio.uspa24.com/

Yasmina BEDDOU

http://www.yasmina-beddou.uspa24.com/

With the Presence of:

* Richard Tzipine, Managing Director of Barnes.

* Eric Donnet, Managing Director of the Daniel Féau Group.

* Sébastien Kuperfis, President of Junot Fine Properties - Knight Frank.

* Martial Michaux, Commercial Director at Emile Garcin

* Thomas Lefebvre, Vice-President Data at Belles Demeures (SeLoger - Meilleurs Agents - Aviv Group)

* Caroline Evans De Gantès, General Manager Belles Demeures (SeLoger - Meilleurs Agents - Aviv Group)

Ruby BIRD

http://www.portfolio.uspa24.com/

Yasmina BEDDOU

http://www.yasmina-beddou.uspa24.com/

Ruby Bird Yasmina Beddou Study Real Estate Prestigious France Market Prices Barnes Richard Tzipine Junot Sébastien Kuperfis Daniel Feau Eric Donnet Martial Michaux Emile Garcin Thomas Lefebvre Seloger Caroline Evans De Gantes Aviv Group

Liability for this article lies with the author, who also holds the copyright. Editorial content from USPA may be quoted on other websites as long as the quote comprises no more than 5% of the entire text, is marked as such and the source is named (via hyperlink).