Business

Dollar turns defense into attack ahead of Fed minutes

Dollar turns defense into attack

Tokyo, Japan (Source: REUTERS/Thomas Peter)

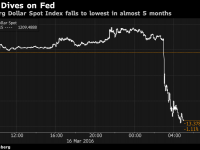

The dollar rebounded from 7-week lows against the yen JPY= as talk of as many two Federal Reserve rate hikes before new year from one Fed official and a move as soon as next month from another set traders up for Fed meeting minutes due later in the day.[/FRX]

European stocks dithered, as an opening push higher quickly reversed to leave London's FTSE .FTSE and Frankfurt's DAX .GDAXI and Paris's CAC 40 .FCHI down 0.2 to 0.8 percent after Asia had eased back from one-year highs overnight.

Oil slipped back from 5-week highs as the dollar's muscle-flexing compounded doubts about whether upcoming talks between top oil exporter countries would result in firm measures to rein in ballooning oversupply.

Group head of multi-asset portfolios at GAM, Larry Hatheway, said attention was firmly on the Fed minutes and particularly why the bank's last meeting ended with a notably cautious statement.

"It wasn't really about Brexit. It is not even about the world economy which isn't in great shape but is somewhat improved from the first quarter fears and its surely not about the cost of capital," Hatheway said.

"So one presumes the caution reflects a thought process about a much lower equilibrium real interest rate ...or possibly the fact that inflation is just not accelerating, which was corroborated to a degree by CPI data yesterday."

With stocks on the back foot, bonds were back in favor, having lost ground for the last two sessions. [GVD/EUR]

Yields on two-year U.S. government bonds notes US2YT=RR briefly touched a near three-week high of 0.758 percent, but they failed to reach the July peak of 0.778 percent and were last at 0.750 percent.

European yields nudged 2-4 basis point lower with Spanish bonds boosted ahead of a meeting later that could pave the way for a new government in Madrid after eight months of limbo.

Interim prime minister Mariano Rajoy is to hold a meeting of his Conservative People's Party (PP) to consider a reforms-for-support offer from centrist rivals Ciudadanos.

"I still have doubts about political progress in Spain and negotiations could still go on for weeks," said DZ Bank strategist Christian Lenk. "But markets do seem to like what's coming out of Madrid."

FED UP

Another shift came in Iceland, which started finally dismantling the capital controls brought in after a banking sector meltdown devastated the economy in 2008

The relaxation will allow Icelanders to start buying property abroad again and freely purchase foreign currency for international trips. It should also further whet investor appetite in a country which already offers by far the highest interest rates -- 5.75 percent -- in western Europe.

terling was helped by data showing the number of people claiming unemployment benefits in the UK unexpectedly fell in July, despite the shock to the economy caused by the June Brexit vote.

In Asia overnight, MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.3 percent while Japan's Nikkei .N225 closed 0.9 percent higher, paring some of Tuesday's sharp losses thanks to a weaker yen as it dropped back below the 100 yen per dollar level. [/FRX]

China's CSI 300 index .CSI300 and the Shanghai Composite .SSEC both erased earlier losses to end the day flat after authorities approved the launch of a long-awaited scheme to allow stock trading between Shenzhen and Hong Kong.

The oil price slide left Brent crude futures LCOc1 down 0.6 percent at $48.92 a barrel, while U.S. crude CLc1 retreated 0.4 percent to $46.40.

That and the U.S. interest rate talk also halted a thundering recent bull run for emerging market stocks and currencies. [EMRG/FRX]

Russian shares eased back from record highs while MSCI's main 27-country EM index .MSCIEF was down 0.7 percent and heading for its first measurable drop in almost two weeks.

"Clearly the Fed seems to think the market's pricing of a September rate hike is too low. Today's minutes of the Fed's July policy meeting could be more hawkish than market expectations," said Tomoaki Shishido, fixed income strategist at Nomura Securities.

(Additional reporting by Dhara Ranasinghe in London; editing by John Stonestreet)

more information: https://http://www.reuters.com/article/us-global-markets-idUSKCN10S03F

Liability for this article lies with the author, who also holds the copyright. Editorial content from USPA may be quoted on other websites as long as the quote comprises no more than 5% of the entire text, is marked as such and the source is named (via hyperlink).